Tax Credit for Going Solar

The good news, if your zip code does not qualify for NO COST SOLAR, The Investment Tax Credit (ITC), or solar tax credit, is a tax credit that rewards solar adopters. You can claim this credit on your federal taxes and receive a credit on the cost of your system, which is deducted from your tax payments. This credit could also show in the refund you receive.

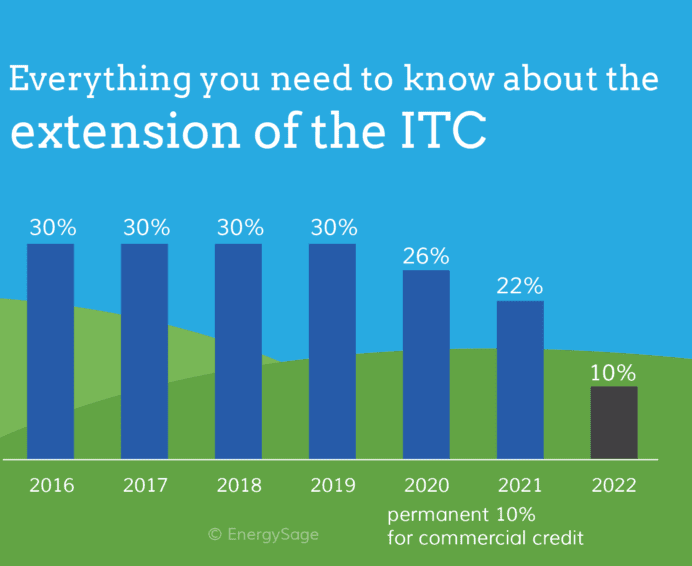

The 2020 solar tax credit rate was 26%, but this percentage decreases to 22% in 2021. To claim the solar tax credit, you must fill out IRS Form 5695 for Residential Energy Credits. . You also should benefit from Modified Accelerated Cost Recovery System (MACRS) depreciation, which allows you to depreciate the solar system over a period of time.